A 360° view of the Enterprise Payments Value Chain

From card issuers and acquirers to gateways and switches, Banks and Payments providers everywhere are working to simultaneously embrace new technologies and keep pace with changing customer demands. The Expert Cards & Payments Masterclass course is a must for Cards & Payments professionals in diverse roles to understand how the end-to-end payment industry works, how to position the bank as both platform-player and participant, and how to cement the Banks role by building an in-depth, expert-led knowledge of the major elements that make up the world of Cards & Payments…FIND OUT MORE

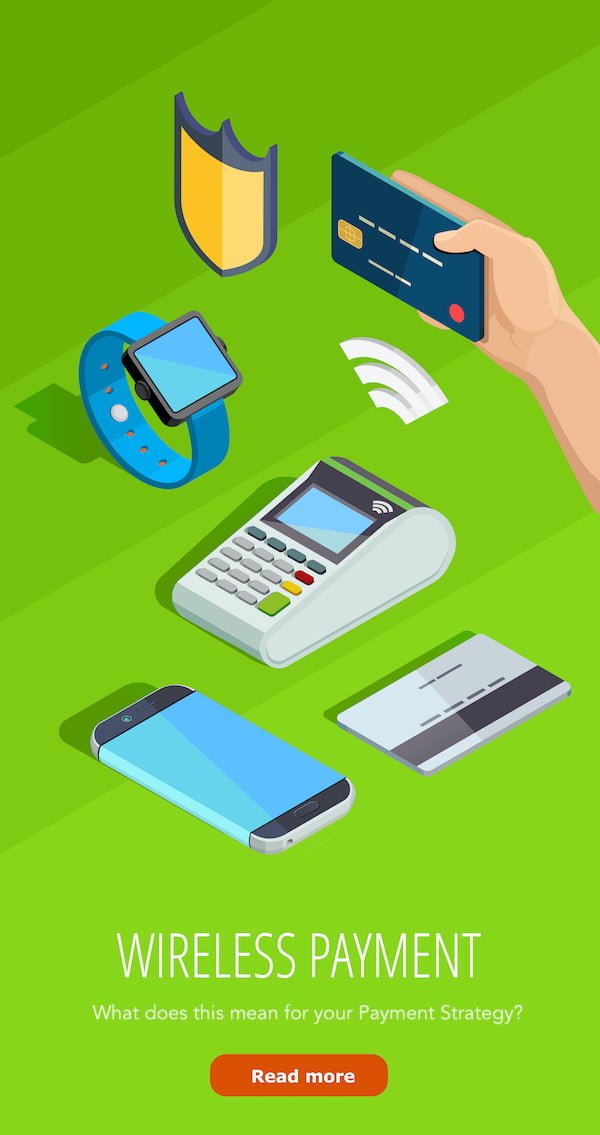

Banks that have traditionally provided end-to- end services across the payments value chain are challenged to change to meet increased competition from Fin-Techs, non-banks and third-party providers. Digital payments and e-commerce providers are building out rival payment methods and their services are attracting more entrants into the payments space, while competition is forcing payments vendors to consolidate and capitalize on economies of scale. Payments processing is also becoming increasingly commoditized, and players are looking for ways to expand their offerings through additional value-added services and consolidation, against their key concerns of how to minimise costs and optimise resources. Meanwhile, smartphones, mobile banking, IoT and payments applications have gone mainstream, while contactless (NFC) payments enable consumers to make everyday purchases quickly and safely, especially for low-value transactions. The result is a dramatic change to how Banks approach payments products and services, and how these are deployed and utilized…