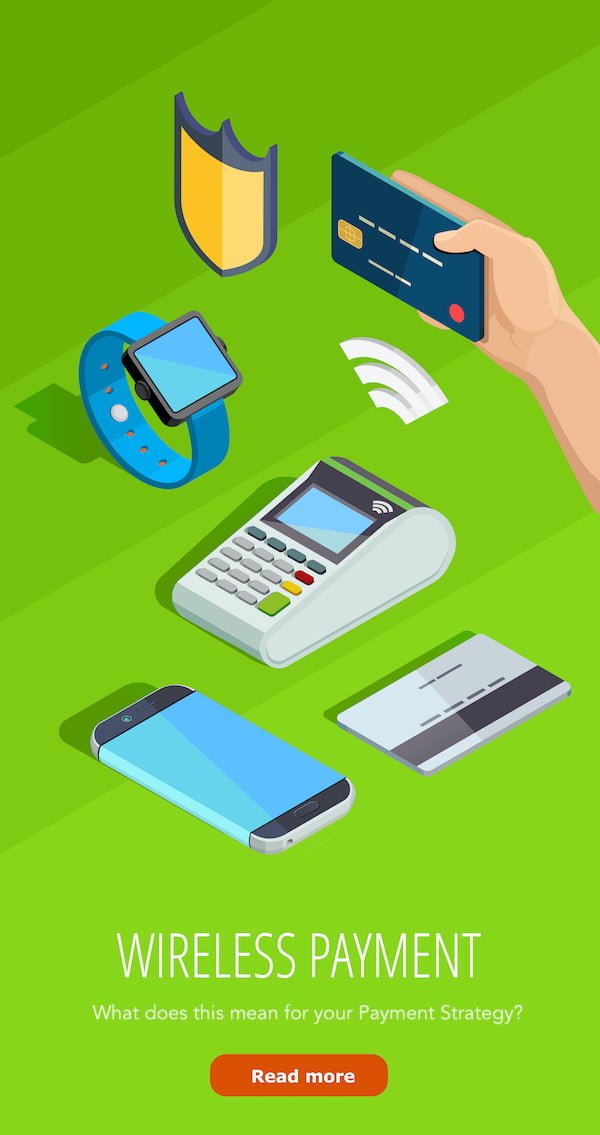

Do You Know the Difference Between a Card Issuer & Acquirer? How deep does your knowledge go? Answer these 35 Questions to find out how much you really know…

________________________________________________________________________________________________________