chatgpt simply explained

chatgpt simply explained

As Bank and Financial Services offerings scale and diversify, so the Cybersecurity Risk and Attacks multiply. Any breach in Banking System Security can come with devastating consequences

Credit Risk Management for Relationship & Portfolio management is more than just long lunches and social calls.

ChatGPT is developed and maintained by OpenAI, a private artificial intelligence research laboratory consisting of the for-profit OpenAI LP and its parent company, the non-profit OpenAI Inc.

Do You Know the Difference Between a Card Issuer & Acquirer? Why are Alternative Payment Methods no longer considered ‘alternatives’? .How deep does your knowledge go? Test your knowledge with these 5 Quizzes

What are the odds that a new, global financial powerhouse will emerge, in the wake of Russia’s ruinous invasion of Ukraine?

Payments Encryption and Security is a critical part of building and maintaining customer trust to prevent fraud and minimise risk loss

Alternative payment methods offer a way for consumers to purchase goods or services using prepaid cards, e-wallets or payment

Advanced Cards and Payments domain knowledge test covering Card terminology, processing & security in the Payment Card Industry

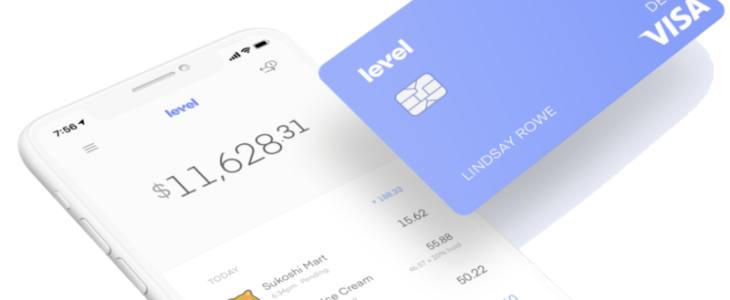

Do You Know the Difference Between the Acquirer and Issuer? The issuer is the card holder’s bank and the acquirer is the merchant’s bank

Home | Sitemap | Our Terms | Contact | Privacy Statement

Copyright © 2020 Solveworx Digital Innovation (PTY) Ltd